What are Share CFDs?

Share CFDs, also called stock CFDs, are contracts for difference on individual shares. They allow traders to speculate or invest in both positive and negative price movements without actually having to buy or sell the underlying share.

Trading Share CFDs vs Index CFDs

An index reflects the average movements of all the stocks within an index, which can result in lower volatility.

Share CFDs reflect the price movements of individual shares which can be more volatile. While it’s rare for one news item to move an index more than a few percent, it is fairly common for a share price to move 5% or greater in a day.

Share CFD trading concentrates on a single company, while index CFD trading concentrates on overall market sentiment.

Share

CFDs

- Higher volatility

- Often move over 5% when news is released

- Influenced by company specific news

Index

CFDs

- Access multiple indices with one trading account

- Trade market action from around the world

- Go long and short, and use leverage with small or large amounts of capital

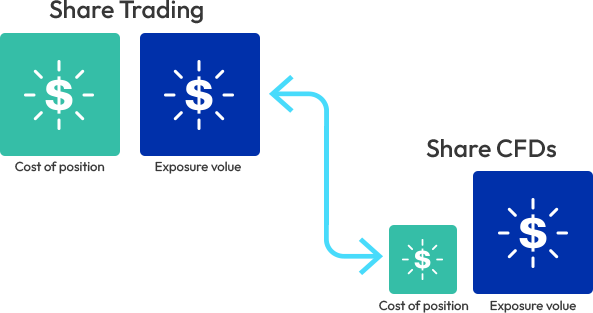

What is the difference between

share CFDs and share trading?

Share CFDs and share trading both allow you to benefit from the rise and fall of a particular stock price, but share CFDs offer advantages that traditional share trading does not.

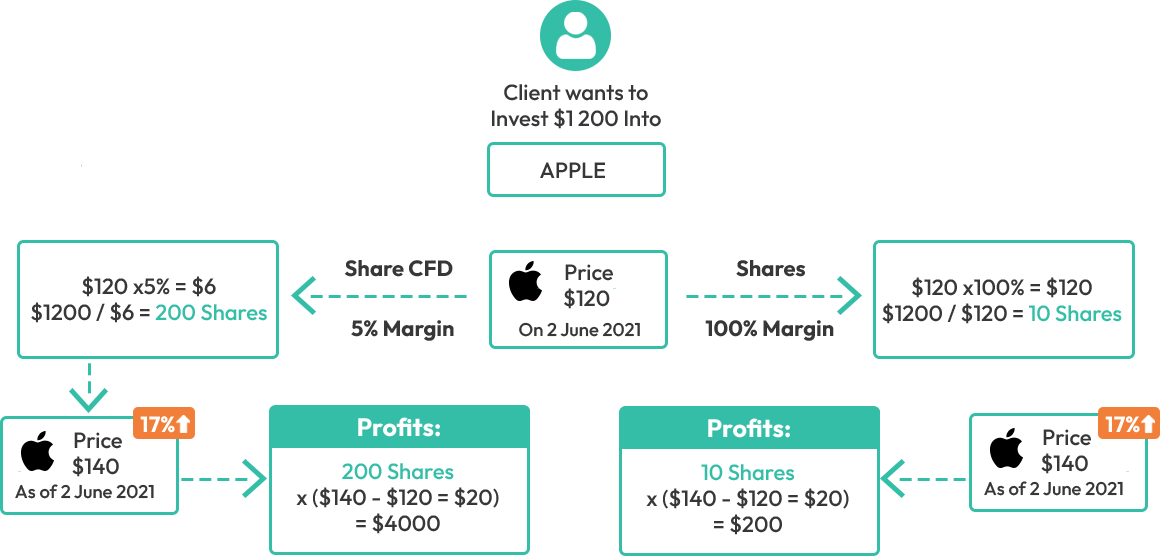

A key benefit is that share CFDs allow you to trade with leverage, meaning you only need to put up a small percentage of the full value of the trade in order to open the position. You also gain the freedom to go long or short, meaning you have the potential to profit whether the price of the underlying stock rises or falls. And because Share CFDs mirror all the rights of the underlying share, you also receive cash dividends.

Stock Boost

Promotion

At LONMARKETS we are aiming to become the global center for Share CFD trading. We are introducing two unprecedented promotions! We are offering 1:50 leverage, highest in the industry and we are also offering extra dividend for selected stocks!

-

Leverage Boost

Leverage Boost

-

Dividend Boost

Dividend Boost

-

Commission-free Trading

Commission-free Trading

Leverage Boost

We are offering up to 1:50 leverage for most popular US and EU stocks. While the industry average for Share CFDs leverage is 1:10, we are offering 1:50 leverage or popular selected stocks.

Dividend Boost

Trading Share CFDs at LONMARKETS mirrors all the rights of the underlying share, you also receive cash dividends as mentioned above. We also offer our clients a dividend boost for selected company shares.These shares will be announced prior to ex-div date and our clients will receive a boost for their dividend earnings up to 50%!

Commission-free Trading

When trading Share CFDs with LONMARKETS, trading costs are included in the spread and there are no extra commission fees charged when opening or closing positions and unlike many other brokers there are no minimum commission levels, so at LONMARKETS you are able to avoid the extra costs of placing smaller trade

Start Trading with Few Simple Steps

It's quick and easy to get started!

Apply in minutes with our simple application process.